IBO Home Living ShowAll Your Home Advice, Under One Roof

IBO Home Living ShowAll Your Home Advice, Under One Roof

April 14, 2012 10:00 am to 6:00 pm Richmond Country Club

The IBO Home Living Show was created to promote the importance of homeownership. I believe that the investment in your home is one of the most important investments you can make and I wanted to develop a platform to help people understand their investment more clearly and simply. Connecting them to the relevant information on the market, the programs and ideas that are available to them now, and introducing them to some of the leading experts in a variety of disciplines. I wanted to use my mortgage expertise in combination with my past event expertise to get people excited about buying, renovating, selling and investing in real estate.

In researching networking opportunities I realized that there was a missing component in the home show market. Many shows, vast in size, heavily weigh their exhibitor’s booths with retail support services with few professional services sections. Other shows chose to focused on one particular demographic, such as investors, eliminating the important cross migration of information to various stages of homeowners. While there is great success in those trade shows, I wanted to introduce a fresh perspective to the home trade show circuit. Hosting a smaller, more intimate setting, focused on education, market trends and advice from leading experts. The goal is to empower home Investors, Buyers, and Owners to be in control of their decisions and financial plans. We want to show the value in being a homeowner and what you need to know, or whom you may need to know, to make better, more secure decisions.

A three tiered approach to learning that can benefit all levels of home owners, including the entry level home owner, those planning to renovate, people looking to sell and the well-seasoned investor. The first tier, keynote speakers, will give the overall real estate market review, what’s hot and what’s not in communities, home fashion, properties and cities. Second tier, the Quick Tip Seminars, will give ideas and information on specific areas of need, such as, mortgage details, special government plans, and investment pointers. Finally, expert advisors in a variety of areas will be available to answer any burning questions. It’s a full service show, with the focus on attendees and their needs. We are encouraging interaction between exhibitors and attendees to connect, discuss, and learn from one another. Attendees to explain their current limitations, while the exhibitors can help find the industry solutions that are available.

It’s is recommended for attendees to review the schedule before arriving in order to select a time that will give the best educational benefit.

The IBO Home Living Show is about learning, connecting and finding the right support. We want to help everyone to be a homeowner, and a better and smarter one at that. Finding the right home or renovation solution, selling faster and for more money and getting incredible value from building the best real estate partnerships is what we want to achieve for our attendees.

Learn more by visiting www.ibohomelivingshow.com or contact Irene directly at info@ibohomelivingshow.com or 778.847.8466. We look forward to seeing you on April 14, 2012.

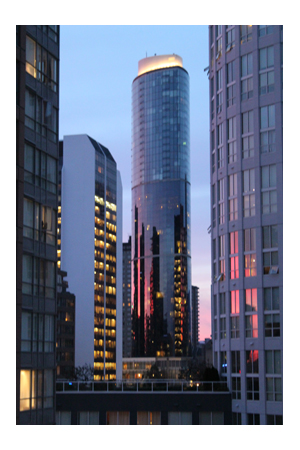

Is Buying in Metro Vancouver Worthwhile?Part II – Considerations in Buying Real Estate

Is Buying in Metro Vancouver Worthwhile?Part II – Considerations in Buying Real Estate Is Buying in Metro Vancouver Worthwhile?

Is Buying in Metro Vancouver Worthwhile?